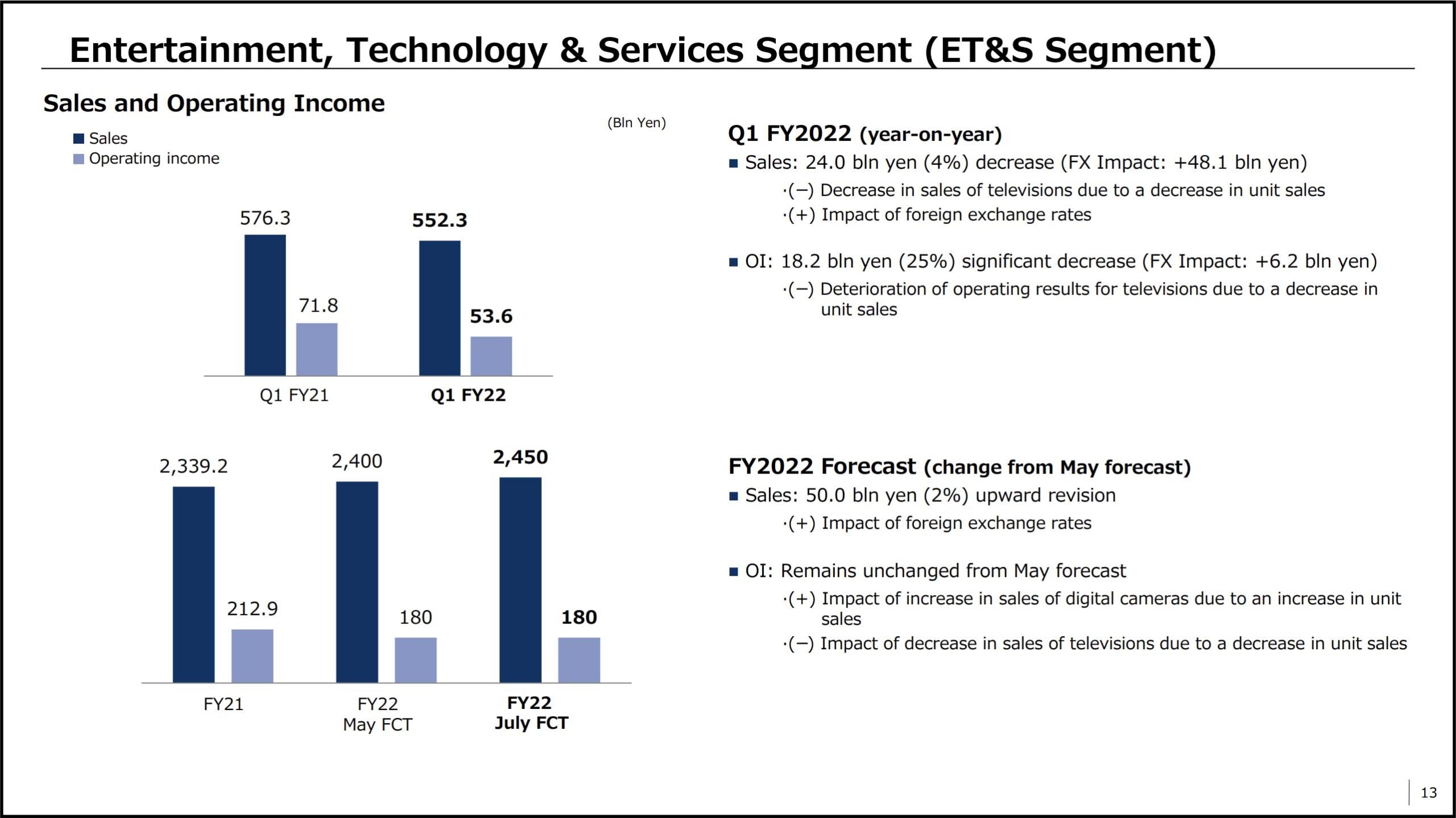

Entertainment, Technology & Services (ET&S) Sales are expected to be higher than the May forecast due to the impact of foreign exchange rates. The forecast for operating income remains unchanged from the May forecast due to the impact of higher unit sales of digital cameras, substantially offset by the impact of lower unit sales of televisions.

- FY22 Q1 sales decreased 4% year-on-year to 552.3 billion yen, primarily due to a decrease in television unit sales resulting from the impact of lockdowns in Shanghai and worsening market conditions, partially offset by the favorable impact of foreign exchange rates.

- Operating income decreased 18.2 billion yen year-on-year to 53.6 billion yen, primarily due to the impact of the decrease in television sales.

- FY22 sales are expected to increase 50 billion yen from our previous forecast to 2 trillion 450 billion yen, primarily due to the impact of foreign exchange rates, partially offset by our incorporating the risk of market deceleration into our forecast for the second half of the fiscal year.

- The forecast for operating income is unchanged from our previous forecast.

Imaging & Sensing Solutions (I&SS) Sales are expected to be lower than the May forecast due to lower-than-expected sales of image sensors for mobile products resulting from a decrease in unit sales, partially offset by an improvement in the product mix, as well as lower-than-expected sales of image sensors for industrial equipment and security cameras. These decreases in sales are expected to be partially offset by the impact of foreign exchange rates. The forecast for operating income remains unchanged from the May forecast mainly due to the positive impact of foreign exchange rates, substantially offset by the impact of the above-mentioned expected decrease in sales of image sensors for industrial equipment and security cameras.

- Sales for the quarter increased 9% year-on-year to 237.8 billion yen, primarily due to the impact of foreign exchange rates.

- Operating income decreased 8.8 billion yen year-on-year to 21.7 billion yen, primarily due to an increase in R&D and depreciation expenses, despite the positive impact of foreign exchange rates.

- FY22 sales are expected to decrease 30 billion yen from the previous forecast to 1 trillion 440 billion yen.

- The forecast for operating income is unchanged from our previous forecast.

via Sony