Imaging & Sensing Solutions

Results for the fiscal year ended March 31, 2020

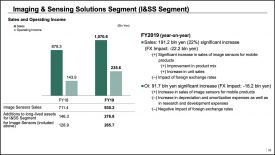

Sales increased 191.2 billion yen (22%) year-on-year (a 24% increase on a constant currency basis) to 1 trillion 70.6 billion yen. This significant increase in sales was primarily due to a significant increase in sales of image sensors for mobile products, resulting from an improvement in product mix as well as an increase in unit sales, partially offset by the impact of foreign exchange rates.

Operating income increased 91.7 billion yen year-on-year to 235.6 billion yen. This significant increase in operating income was primarily due to the impact of the above-mentioned increase in sales, partially offset by an increase in depreciation and amortization expenses as well as in research and development expenses and the negative impact of foreign exchange rates. During the current fiscal year, there was a 18.2 billion yen negative impact from foreign exchange rate fluctuations.

Current View Regarding the Impact on the Business from the Spread of COVID-19

As of today, there has been no major impact on Sony’s manufacturing plants in Japan, which are operating as usual. Sony also understands that factory operations and supply chains at most of its major mobile customers, to whom it sells its image sensors, have been recovering. On the other hand, Sony continues to monitor the extent to which the final outlet for Sony’s products, the smartphone market, may decelerate going forward.

• Next is the Imaging & Sensing Solutions (“I&SS”) segment.

• FY19 sales increased 22% year-on-year to 1 trillion 70.6 billion yen primarily due to an increase in image sensors unit sales for mobile devices and an improvement in product mix.

• Operating income increased a significant 91.7 billion yen year-on-year to 235.6 billion yen primarily due to the impact of the increase in sales, partially offset by an increase in depreciation expenses and research and development costs, as well as the negative impact of foreign exchange rates.

• Due to several positive factors occurring simultaneously, such as strong demand, acceleration of the shift to larger-sized, high value-added products and our introduction of a highly competitive new product which fit those specifications, the image sensor business produced results that significantly exceeded our expectations at the beginning of the fiscal year.

• Now I will discuss the impact of the coronavirus on the I&SS segment.

• As of today, there has been no major impact from the coronavirus on our manufacturing facilities in Japan, which are operating as usual.

• Moreover, we understand that the factory operations and supply chains of our major mobile customers have been recovering.

• On the other hand, we believe that the decrease in shipments of our image sensors was relatively minor compared to the impact the coronavirus had on the manufacturing and sales of our mobile customers in the fourth quarter ended March 31, 2020, so there is a possibility that inventory in the supply chain of those customers has increased.

• In addition, we are monitoring how much the final outlet for our products, the smartphone market, may decelerate going forward.

• Now I would like to discuss the current state of our I&SS business.

• Considering the deceleration of the smartphone market due to the impact of the coronavirus, there is a possibility that image sensor sales this fiscal year will be flat year-on-year.

• At this point in time, there is no change to our view that image sensors will drive improvements in the functionality of cameras, which are a major differentiating factor for smartphones, or our view as to the expansion of demand over the mid- to longterm. Thus, we have already decided to invest more than 80% of the cumulative capital expenditure we planned to make over the three years of our mid-range plan.

• However, given the uncertain operating environment, we will postpone as long as possible decisions regarding the remaining capital expenditures so we can make appropriate and timely decisions after gathering more market information.

• In addition, we will be disciplined in our prioritization of research and development spending, but we plan to maintain the current level of spending as we manage Sony for the mid- to long-term.

via Sony.net