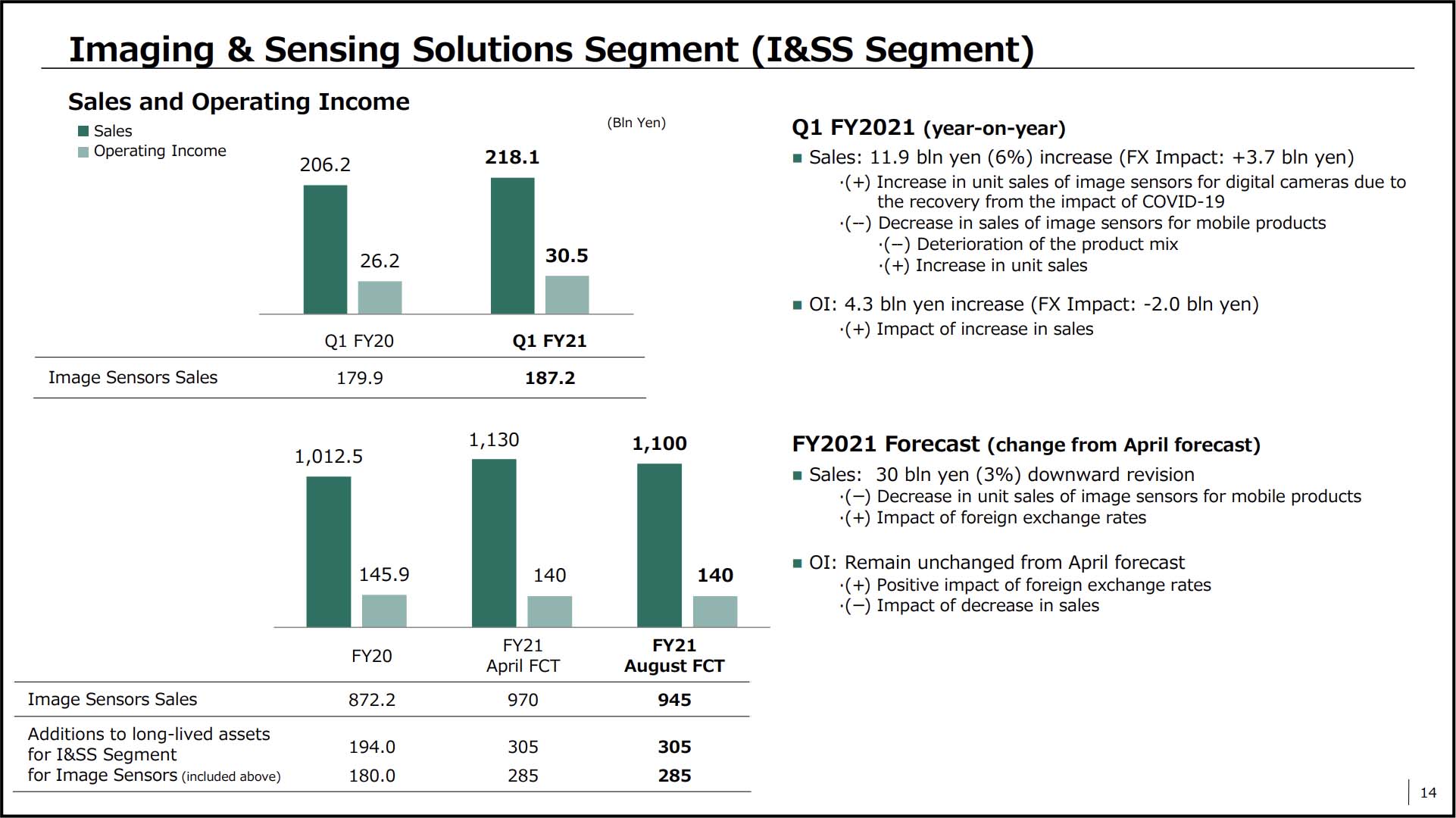

Electronics Products & Solutions (EP&S)

Sales are expected to be higher than the April forecast due to the impact of foreign exchange rates as well as higher-than-expected sales of digital cameras due to higher unit sales, partially offset by lower-than-expected sales of televisions due to lower unit sales. Operating income is expected to be higher than the April forecast due to an increase in unit sales and an improvement in the product mix of digital cameras as well as the positive impact of foreign exchange rates, partially offset by the above-mentioned lower unit sales of televisions.

- Next is the Electronics Products & Solutions (“EP&S”) segment.

- Primarily due to an increase in unit sales of televisions and digital cameras, as well as the impact of foreign exchange rates, sales for the quarter increased significantly to 576.3 billion yen, a 59% increase compared to the same quarter of the previous fiscal year which was severely negatively impacted by COVID-19.

- Operating income increased a significant 80.6 billion yen to 71.8 billion yen year-onyear, primarily due to the benefit of the increase in sales and an improvement in the product mix.

- FY21 sales are expected to increase 60 billion yen compared to the previous forecast to 2 trillion 320 billion yen and operating income is expected to increase 22 billion yen to 170 billion yen to reflect the results of FY21 Q1.

- In the TV business, the market for high-value-added, large-screen products, which is our focus, remains strong, but we are beginning to see a decline in the stay-at-home demand that has continued since last fiscal year in the market for low-priced, smalland medium-sized products. While the supply of TV panels is tight, we have maintained price and shifted our focus to higher value-added models, resulting in our average selling price rising a significant 38% year-on-year.

- In the digital camera business, which suffered a significant contraction in demand around the world due to COVID-19, sales are strong in all regions due to a recovery in demand and a shift in the market to high-performance and high-spec products, as well as our strong product competitiveness.

- At the same time, the recent resurgence of COVID-19 in Southeast Asia has caused governments to place restrictions on personal and corporate activity, and we have had to reduce our operations at our factories in Malaysia from the end of May. There is a risk that parts of our component supply chain could also be negatively impacted.

- Our FY21 forecast incorporates these emerging supply-side risks as well as demandside risks, such as lower stay-at-home demand from the second half of the fiscal year

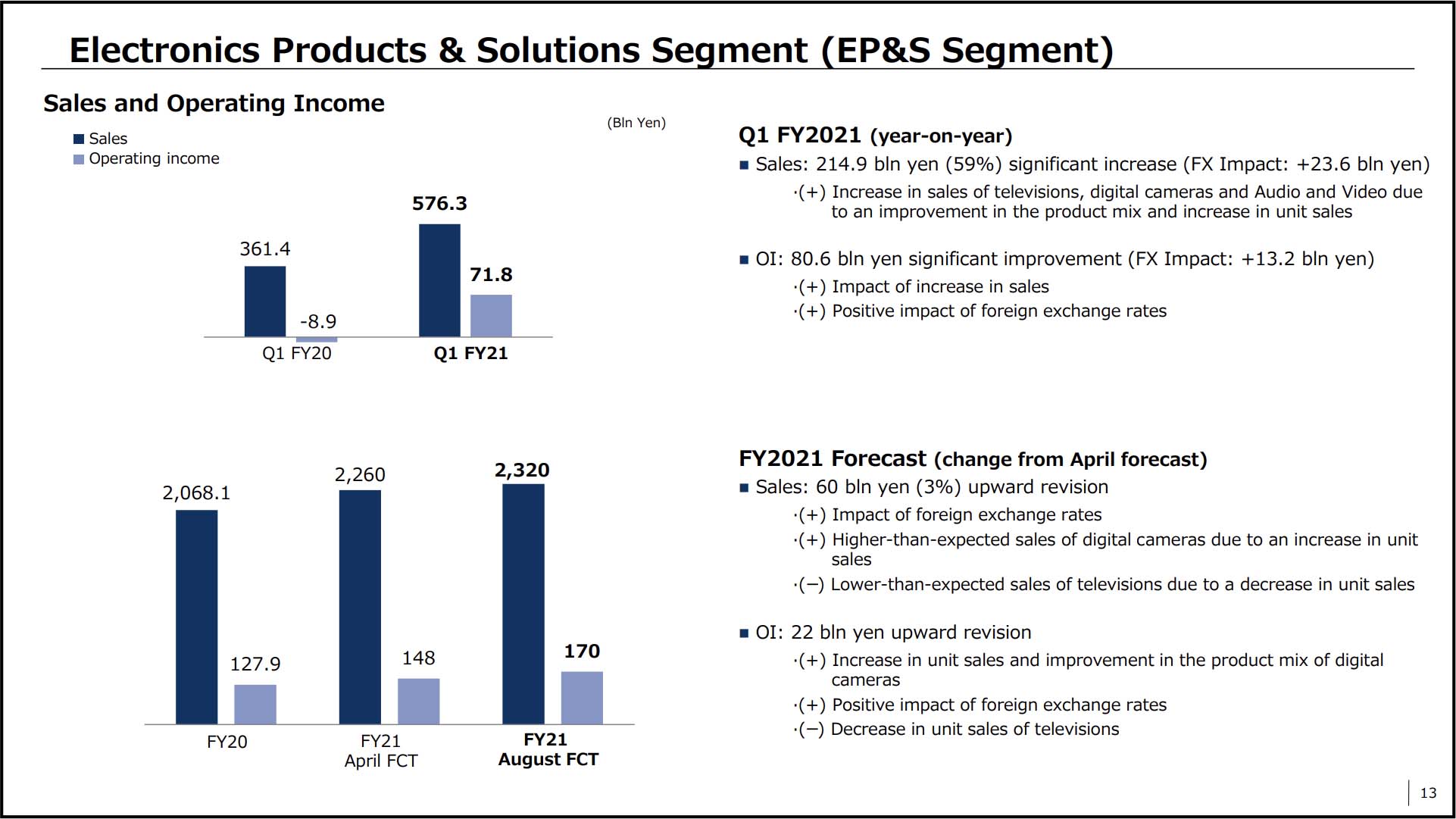

Imaging & Sensing Solutions (I&SS)

Sales are expected to be lower than the April forecast due to an expected decrease in unit sales of image sensors for mobile products, partially offset by the impact of foreign exchange rates. Operating income is expected to remain unchanged from the April forecast mainly due to the positive impact of foreign exchange rates, substantially offset by the above-mentioned decrease in sales of image sensors for mobile products.

- Next is the Imaging & Sensing Solutions (“I&SS”) segment.

- FY21 Q1 sales increased 6% year-on-year to 218.1 billion yen and operating income increased 4.3 billion yen year-on-year to 30.5 billion yen.

- FY21 sales are expected to decrease 30 billion yen compared to our previous forecast to 1 trillion 100 billion yen but our operating income forecast remains unchanged from the previous forecast.